Trending Topics

Most Popular

Brainwonders - 07 January,2024

Brainwonders - 17 January,2024

Brainwonders - 05 February,2024

Latest Articles

30 April,2025 | By Brainwonders

03 April,2025 | By Brainwonders

03 April,2025 | By Brainwonders

03 April,2025 | By Brainwonders

03 April,2025 | By Brainwonders

03 April,2025 | By Brainwonders

29 March,2025 | By Brainwonders

28 March,2025 | By Brainwonders

27 March,2025 | By Brainwonders

26 March,2025 | By Brainwonders

All (722)

Which Course After 10th(77)

What Are Courses After 12th(191)

Career Counselling and Career Guidance(70)

Top Courses In India(67)

Careers(61)

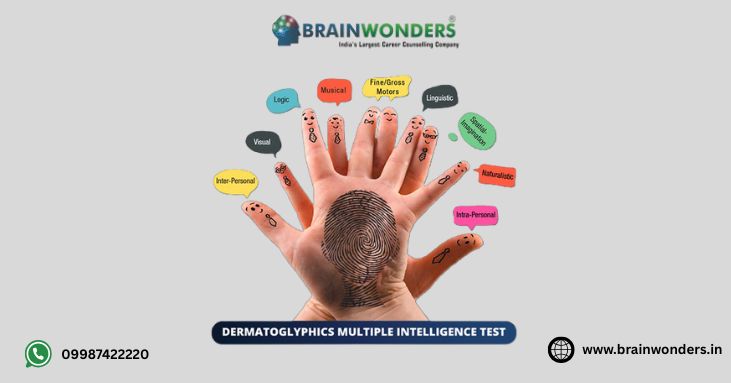

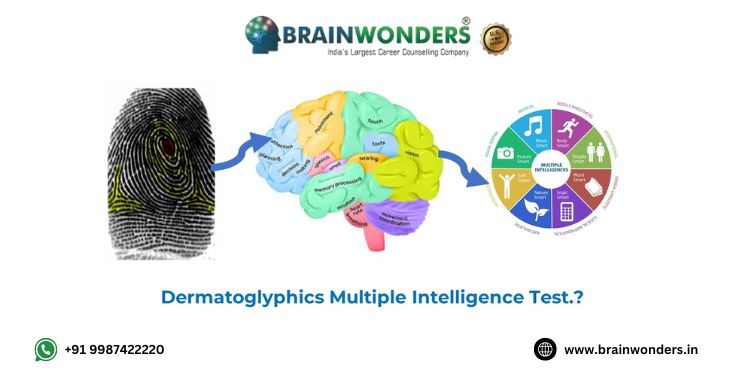

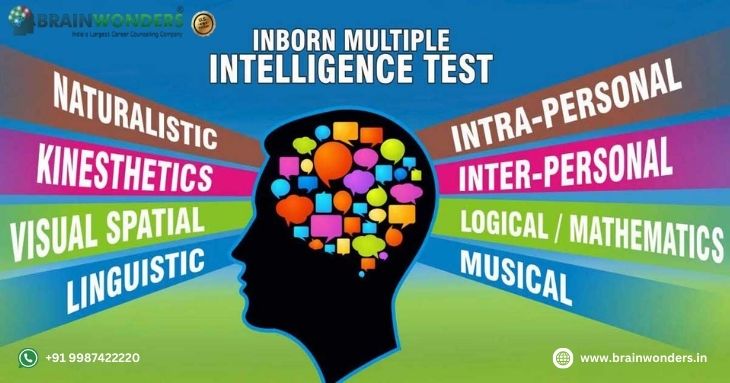

DMIT Test(15)

Online IQ Test(11)

Psychometric Test Online(10)

Personality Test(3)

Toughest Exam In India(89)

Highest Paying Jobs In India(9)

Top University In India(5)

Top Colleges In India(14)

Role of Parents in Career Selection(10)

Aptitude Test(15)

Study Abroad(7)

Must Read(39)

DMIT Franchise(10)

Events And Exhibitions(19)

_Courses,_Admissions,_Eligibility,_Syllabus,_Career.webp)